Budgeting is one of the most powerful financial skills you can develop, shaping your future with even the smallest adjustments over time A well-designed budget reflects your values, routines, and way of life and isn’t just about numbers. Making little adjustments is essential for long-term success since spending habits are shaped by prior experiences. The good news? Making a customized budget for yourself doesn’t have to be difficult. You can confidently take charge of your finances by making a small change, improving as you go, and getting help when you need it. We’ll take you step-by-step through the process of making and adhering to a realistic budget in this guide.

<h2>Calculate Your Income</h2>

- Make a list of your expenses into fixed (rent, utilities, loan payments) and variable (groceries, entertainment, dining out).

- To monitor spending trends, look over previous bank statements or utilize budgeting applications. Even your bank statements now provide you with a monthly breakdown of your income and expenses, which you may use as a useful guide.

- Set Financial Goals

- Short-term goals: Emergency fund, debt repayment, travel.

- Long-term goals: Home purchase, retirement savings, investments.

- Prioritize saving and debt repayment alongside daily expenses.

- Create Spending Categories & Allocate Funds

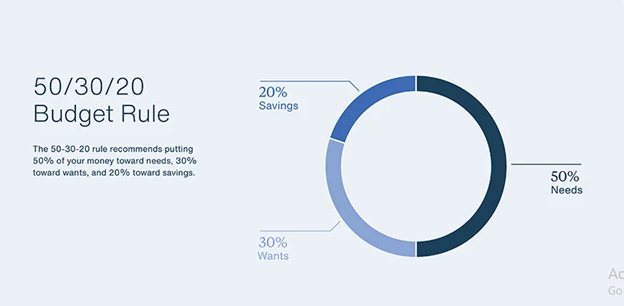

The 50-30-20 rule recommends putting 50% of your money toward needs, 30% toward wants, and 20% toward savings: (Budgeting basics: The 50-30-20 rule, 2025)

- 50% Needs – Rent, groceries, transportation, insurance.

- 30% Wants – Dining out, subscriptions, entertainment.

- 20% Savings & Debt Repayment – Emergency fund, investments, loan payments.

- Track & Manage Spending

- Use budgeting tools like Mint https://mint.intuit.com/ or Excel

- Set spending alerts to avoid overspending

- Cut non-essential expenses and find cost-effective alternatives

- Build Financial Stability

- Save 3-6 months of expenses in an emergency fund

- Pay off high-interest debt as a priority

- Use credit wisely and invest in future goals

- Review & Stay Consistent

- Adjust your budget regularly based on income/expenses

- Automate savings and control spending with tools like the envelope system

- Stay motivated with rewards and accountability partners

Final Thoughts

Budgeting isn’t about restriction—it’s about control and freedom. Start small, stay flexible, and adjust as needed. Progress matters more than perfection. Be patient, celebrate small wins, and seek support when needed. A good budget empowers you to spend wisely while securing your future. Take the first step and watch your finances transform